What Is the Purpose Of A Prenup?

When you’re a soon-to-be husband and wife deep in love, nothing can bring that bliss to a crashing halt quite as quickly as opening the subject of a prenuptial agreement. Those pieces of paper spark feelings of distrust and fear, and often bring up the defenses. Before you spiral too far out of control with those feelings, it’s important to sit back, take a deep breath, and look a little closer look at the purpose of a prenup.

What is a Prenuptial Agreement?

A prenuptial agreement is a contract written by an unmarried couple before marriage that allows them to select and control many legal rights acquired upon marrying, and what happens to those rights if the marriage ends by divorce or death.

According to Nolo, “A prenuptial agreement (“prenup” for short) is a written contract created by two people before they are married. A prenup typically lists all of the property each person owns (as well as any debts) and specifies what each person’s property rights will be after the marriage.”

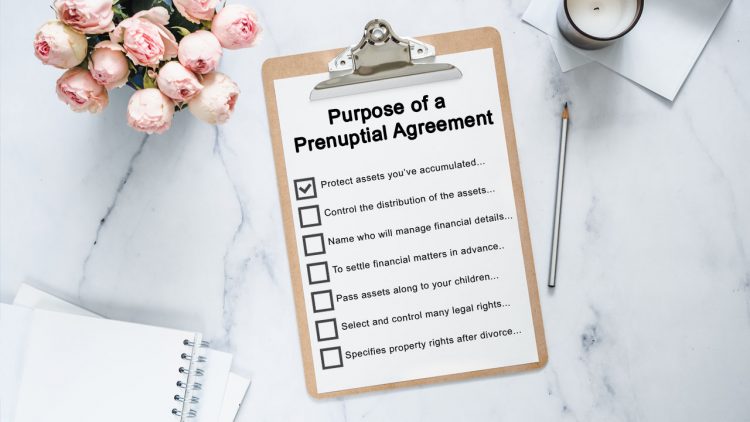

What is the Purpose of a Prenup?

Understanding a prenup is the first step to recognizing the purpose of a prenup. The easiest way is to look at some of its applications. It’s important to note they don’t necessarily have to do with divorce but can address the death of a spouse as well. Some of the applications are:

- Protecting assets you’ve accumulated before your marriage, and specifying what you want to do with them. For example, you may want to pass them along to children you had from a previous relationship. Or perhaps you’re passionate about a charity and want those assets given to them.

- You can specify numerous things that have to do with finances. Things like which debts belong to which party, or what portion of funds belong to the individual, and which will be jointly shared by the couple.

- A prenup can name who will manage financial details and handle assets.

- A prenuptial agreement can have a spouse waive rights to your retirement plan and name a different beneficiary.

- A prenup is a safeguard when there is a large age or financial disparity. Thereby allowing a party to control the distribution of the assets they will bring into a relationship.

The bottom line is that the purpose of a prenup is to give rights to an individual to do anything they want with assets they had before the marriage.

According to HowStuffWorks, “It may also be called a premarital agreement, an antenuptial agreement, a marriage contract or a prenup for short. Its purpose is to settle financial matters in advance in the event of either a divorce or death. While a prenuptial agreement may seem unromantic, some experts say it’s just smart financial planning.”

While it’s easy to look at a prenup as something that says, I don’t trust my partner, typically, that’s not the case.

It’s about honoring what your future spouse has, and giving them the choice to be able to do with it what they want. In many ways, it gives peace of mind that can prevent arguments within the marriage.

Everything Prenuptial Agreements Can Protect

Prenups give married people broad rights to detail financial and personal conditions regarding married life, including issues like:

Property Rights and Responsibilities

When one spouse enters the marriage with their own separate property, a well-devised prenup could contain a condition detailing that maintenance expenses post-divorce would not fall on the person without an ownership interest.

Division Of Property

Essential to any good prenup are provisions detailing how marital and personal property needs to be divided in the occurrence of a divorce, like vehicles or second homes. So long as such provisions aren’t considered unfair or unreasonable, the law permits broad freedoms for married people to choose to break up assets.

Additionally, bear in mind that prenups can be utilized to divide any debts sustained throughout the marriage. Should your future spouse plan on continuing their schooling, for instance, a prenup can stipulate that repaying that educational debt is the spouse’s obligation.

Dependents’ Interests

For partners with children or dependents from a former marriage, these agreements are a perfect way to safeguard them in the event of divorce. In particular, prenups can set aside portions of property or other assets that are planned for existing dependents and, per se, should not be deemed marital property.

Spousal Support

When most people consider prenups, they are inclined to think of alimony. And even though it’s typical for prenups to renounce rights to alimony totally, they can also be used to set a minimum alimony. In doing so, both partners know the slightest of what to expect through their separation.

Life Insurance Policies

A prenup can contain stipulations outlining how to manage a life insurance plan, either by designating your spouse as beneficiary or naming someone else to receive a portion of the payout. Additionally, these agreements can be utilized to require that your partner acquire a life insurance policy to guarantee you’re taken care of in the event of their passing.

Will and Trust Considerations

Prenups and estate planning documentation have a complicated relationship however, the courts are going to usually favor a prenup over a will. In addition, a prenup can necessitate that your spouse devises a will, establish how marital property needs to be divided following death, or waive each spouse’s right to their spousal share of a pre-existing will.

Inheritances

For those who expect to receive an inheritance, a prenup is a perfect way to safeguard those future assets from turning into shared marital property.

Which State Law Is Going to Govern the Agreement?

As mentioned above, the laws concerning prenuptial agreements may vary considerably from each state. Due to this, a lot of prenups indicate which state’s laws should be used to govern or adjudicate the agreement.

See Also:

- Prenuptial Agreement Checklist

- How You Can Get An Ironclad Prenup

- How much does a prenuptial agreement cost?

- How long does a prenup last?

- Pros and cons of a prenup

Trust Ogborne Law for Your Prenuptial Agreement in Phoenix, AZ

At Ogborne Law, we dedicated our time to working with couples as they hash out the details of a prenuptial agreement. We understand that the process can be stressful, and aim to make it easy and straightforward. Ogborne Law we work on a flat-fee basis according to your needs. The costs can vary from a few thousand dollars to tens of thousands depending on what you need to cover. Learn more about the cost of a prenup in Arizona.

Our service area for prenuptial agreements in Phoenix, Arizona including Paradise Valley, Fountain Hills, Cave Creek, Carefree, and more. We also service many popular Phoenix neighborhoods such as Paradise Valley Village, Desert Ridge, Desert View Village, Norterra, Deer Valley, North Mountain Village, Arrowhead Ranch, Camelback East Village, Arcadia, Kierland, and more.

We also offer services that include the evaluation of business and estate planning. These services can work in conjunction with your prenuptial agreement to ensure your complete protection in the case of divorce. To better understand your options and the cost associated with prenuptial agreements call Ogborne Law today for a consultation. We are happy to answer all your questions from “How much does a prenup cost?” to “how do I talk to my fiancé about it?”

Engaging with an attorney to protect your family is never an easy step. Whether you need to protect your family from the unthinkable or restructure your family through collaborative divorce, we’re here to help. When you’re ready to schedule a consultation with Michelle Ogborne, please visit the scheduling page to get started.