Estate Planning Vs Will

An estate plan is a broad plan of action for an individual’s assets that may apply both during your life and upon death. A will, meanwhile, dictates where the assets will go after death. Let’s take an in-depth look at the differences between estate planning and wills.

What Is Estate Planning?

Property ownership, relationships, and lifestyle changes are what life’s all about. When compared with the Kardashians, you may not feel your modest assets deserve mention in a will or a trust fund for the kids. But even if you don’t own a Caribbean Island or a fleet of collectible cars, you need to understand estate planning basics.

You need estate planning because everything in your life has value. But for many people, death and dying is an emotional subject, especially when you’ve recently married or had a child. What you want to avoid is drama. If you understand estate planning basics, you’ll know why you should make provisions for your valued property – financial and nostalgic – by acting now. Estate plans are especially appropriate:

- After marriage.

- Before marriage.

- During divorce.

- Following a child’s birth.

- Upon the death of one or both parents.

- When you are facing health issues.

- When you realize you are not immortal.

Estate Planning Process

You want to do what’s best for your family, especially your children, so estate planning basics should be discussed as soon as possible. Estate planning is like insurance, and you should regularly review and change it when necessary. You can engage another family member to join you when you understand estate planning basics and are ready to act. Here’s the 5-step process the Ogborne Law estate planning professionals will employ:

- Assess – Let’s discuss your family dynamics and evaluate your assets. What are your goals? What are your concerns?

- Plan – We create an initial estate plan that incorporates your goals for your family and addresses your concerns.

- Review – You’ll review and edit documents, and we’ll make required changes.

- Implementation – When the documents are exactly as you wish, you will sign-off.

- Check-up – So many changes can occur in just one year! Tax time is a good time to review your estate planning documents and update.

Why Estate Planning Matters

Here are a few reasons why estate planning is essential for each and every individual.

You Can Choose Your Beneficiaries

First of all, having an estate plan will prevent your assets from going to people you prefer they didn’t. No matter what you have—homes, stocks, TVs, furniture, jewelry, or even pricey artwork—you can determine now where all of it will go when you pass.

If you don’t outline who will be the beneficiary of which asset, then the courts will decide for you. And if your estate winds up in probate, it can take years to assign which component of your asset falls to which relative.

It’s also expensive to go through probate. And worse, it breeds animosity to have all of that fighting among your loved ones over what they think you wanted to have happen to your estate.

If You’re Starting (Or Have) A Family

An especially important time to consider creating your first estate plan is when you get married and have children. Estate planning is generally thought of as how valuables, properties, and possessions will be divided up, but another crucial aspect of an estate plan for families is the guardianship of your children.

In the event that both parents die—and you have not designated a guardian—the courts will decide who will raise them. Don’t let your children go through the court systems while relatives fight, have an estate plan.

To Avoid Tax Penalties

Another great reason for estate planning is protecting your family and loved ones from unnecessary tax burdens. Remember that an estate plan is much more than a will.

You can create a number of devices to shield your assets from taxes as you pass them on to your dependents. With proper planning, you can reduce or completely eliminate all federal and state taxes from of your belongings. Without a plan, your heirs could end up paying a lot in taxes.

A Simpler Transition

In most cases, the best possible reason to plan your estate is to eliminate family chaos when you’re gone.

We’ve all heard of these fights families have after a loved one dies—over property, stocks, and other valuables.

You can avoid this possibility before it ever begins with some smart estate planning. This will allow you to choose who controls your estate, will go a long way in eliminating any differences in opinions, and allows the process to run much smoother.

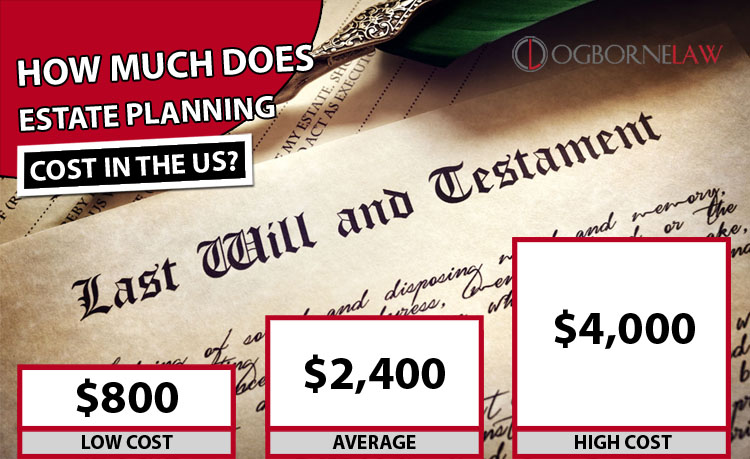

How Much Does Estate Planning Cost?

On average, estate planning costs about $2,400, with average prices ranging from $800 to $4,000 in the US according to CostHelper. Average hourly rates to hire an estate planning attorney is about $225 per hour, with average prices ranging from $150 per hour to $310 per hour. according to Lawyers.com and other sources.

What Is A Will?

A will is a document that states what you want to happen after your death. It’s sometimes referred to as your “last will and testament.” If you die without a will, your estate is distributed to your family following general, pre-established guidelines. This means your estate may be divided in a way you didn’t want. The people you hoped would inherit your estate may not. Your will can include:

- Beneficiaries

- Business assets/distribution

- Care for your pets

- Disposal of debts/taxes

- Guardianship for your children and their inheritance

- Property beneficiaries

- The executor of your estate

What Does A Will Do?

A will can be used to:

- Choose an executor

- Choose a guardian for your children and their property

- Make decisions about how taxes and debts will be paid

- Leave instruction about what needs to happen to your property after you die

- Can be used a backup to a living trust

- Protect minor beneficiaries

What Happens If You Do Not Have A Will?

If you do not have a will and you die, the intestacy laws of your state will decide how to distribute your property. This will include decision of your bank accounts, real estate, securities, and any other assets you might own at the time of your death. Intestacy laws differ depending on whether you have children, are married, or single at the time of your death.

In many cases, property gets distributed to your heirs if you do not have a will. An heir could be a surviving spouse, siblings, parents, uncles and aunts, nephews, nieces, and other distant relatives. If you have no heirs, your entire estate goes to your state of residence.

Who Needs A Will?

Almost everyone should have a will in place. You may think you are not rich enough to need one or the law will take care of everything. Arizona, like every other state, has laws in place to determine what happens to your property if you do not have an estate plan. However, if you rely on the state, you lose all say in what happens after you pass.

If you have money or property, you probably care about what happens to it. This can include personal items with sentimental value, as well as money or business holdings. Further, if you have minor children, you don’t want to leave it to the government to work out what should happen to them. In short, if you have anything or anyone you care about, you should have a will in place.

How A Will Works

A will allows you to describe your wishes for what happens after you pass. You can create one document for yourself and your spouse, or separate documents for each of you. They can outline what happens to your property, assets, debts, and any minor children under your care when you die. A will lays out any specific gifts, personal items you want to give to people, as well as general bequests for dividing your estate. In Arizona, you must sign your will in order for it to be valid. You must have two witnesses sign as well.

Having this document in place does more than direct your wishes. It also gives peace of mind to the people you love. It allows them to know what you wanted and know you’re caring for them even after you pass on. It’s a final way for you to take care of those who matter in your life.

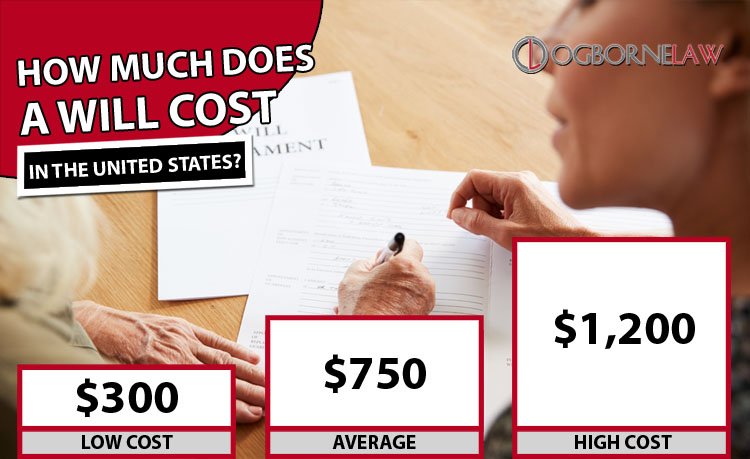

How Much Does A Will Cost?

Do it yourself will preparation costs about $150. The average cost to have a lawyer draft your will for you comes with a price tag of $750 with average prices ranging anywhere from $300 to $1,000 in the US, according to Investopedia and multiple online sources.

Speak With Our Estate Planning Attorneys In Phoenix, Arizona Today

Estate planning is the right thing to do for the people you love. It’s another way to say “thank you” to those who love you. Some of the decisions are hard, but at Ogborne Law, we will help you navigate these difficult decisions.

Your Arizona estate planning attorney can help you select a will or trust or both. Your estate solution will work for you. You will have the peace of mind that comes with effective planning for the future. Call 602.343.1435 or contact Ogborne Law with questions.

Engaging with an attorney to protect your family is never an easy step. Whether you need to protect your family from the unthinkable or restructure your family through collaborative divorce, we’re here to help. When you’re ready to schedule a consultation with Michelle Ogborne, please visit the scheduling page to get started.